Tax rebate for self. The deadline for filing income tax in Malaysia is April 30 2019 for manual filing and May 15 2019 via e-Filing.

Taxes From A To Z 2019 D Is For Due Dates

LHDN urged taxpayers to submit their forms and pay their income tax within the stipulated.

. 20182019 Malaysian Tax Booklet 18 b there was no material omission or misrepresentation in or in connection with the application of the ruling. What is the last date for filing income tax 2020. Employment income e-BE on or before 15 th May.

Date of online submission may subject to change. 20182019 Malaysian Tax Booklet Income Tax. Employment income BE Form on or before 30 th April.

Restriction On Deductibility of Interest Section 140C Income Tax Act 1967 International Affairs. Extension of Two Months for Filing Malaysia Income Tax 2020. A non-resident individual is taxed at a flat rate of 30 on total taxable income.

Malaysia Non-Residents Income Tax Tables in 2019. It is hereby further extended to the 15th of January 2022 the deadline for furnishing Report of Audit under any provision of the Act for the Previous Year 2020-21 which was previously extended to the 31st of October 2021 by Circular No. Income Statutory deadline March 31 2020 April 30 2020 June 30 2020 Existing grace period -.

Income Tax Rates and Thresholds Annual Tax Rate Taxable Income Threshold. Dates section for further information. A tax return submitted by the prescribed.

Business income e-B on or before 15 th July. The above is a complete guide for. If your chargeable income after tax reliefs and deductions does not exceed RM35000 you will be granted a rebate of RM400 from your tax charged.

The deadline for filing your income tax returns in Malaysia is 15 May 2020 via e-Filing and 30 April 2019 for manual filing for resident individuals who do not carry on business. A tax rebate directly reduced your amount of tax charged and there are currently four types of tax rebates for income tax Malaysia YA 2019. The new deadline for filing income tax returns in Malaysia is now 30.

Malaysia Various Tax Deadlines Extended Due. The following rates are applicable to resident individual taxpayers for YA 2021 and 2022. The applicable forms are E BE B P BT M MT TF and TP.

Now that youre up to speed on whether youre eligible for taxes and how the tax rates work lets get down to the business of actually filing your taxes. In a statement released today LHDN urged taxpayers to keep important details up. A qualified person defined who is a knowledge worker residing in Iskandar Malaysia is taxed at the rate of 15 on income from an employment with.

Income Tax Return Forms ITRF in the non-business category for assessment year 2019 have to be submitted by 30th June. For instance companies for year of assessment YA 2019 whose accounting period ends. For further information kindly refer the Return Form RF Program on the.

Meanwhile resident individuals who carry on a business have until 15 July 2020 via e-Filing and 30 June 2020 for manual filing. 20182019 Malaysian Tax Booklet 18 b there was no material omission or misrepresentation in or in connection with the application of the ruling. Employer Individuals Companies especially on the type of Forms to be submitted throughout the year 2019 due dates as per the relevant Act and the grace.

Malaysian income tax return form filing programme for the year 2019 for all income tax return forms with due dates as per the relevant Act and grace periods and more. Also the MIRB has closed all its office premises until 14 April 2020. The CP38 notification is issued to the employer as supplementary instructions to clear the balance of tax liability of employees over and above the Monthly Tax Deductions MTD 30th June 2022 is the final date for submission of Form B Year Assessment 2021 and the payment of income tax for individuals who earn business income.

92021 dated 20052021 and. Other income tax filing dates have been extended. 20182019 Malaysian Tax Booklet Income Tax.

A tax return submitted by the prescribed. The income tax filing process in Malaysia. Income Tax Rates and Thresholds Annual Tax Rate.

Under this taxpayers have been granted an extension of time two-month grace period to submit tax returns. The Malaysian Inland Revenue Board MIRB has set out a new timetable for certain personal tax filing and employer compliance obligations including due date extensions in light of the COVID-19 crisis. This Insight summarises the revised grace period accorded by the MIRB for the Malaysian tax year calendar year 2019 and other measures taken by the MIRB in this time.

The Malaysian Inland Revenue Board issued a series of releases 20-25 March 2020 that provides tax relief measures including postponed tax filing deadlines. CYBERJAYA Feb 28 Taxpayers can submit their income tax return forms for 2019 via the e-Filing system starting March 1 the Inland Revenue Board of Malaysia LHDN said in a statement today. The Government has announced an extension of two months for filing income tax from the original deadline in consideration of the Movement Restriction Order MRO that has been enforced during the COVID-19 pandemic.

The Inland Revenue Board LHDN is reminding Malaysians that the deadline for filing and submitting their income tax forms is fast approaching. Review the 2019 Malaysia income tax rates and thresholds to allow calculation of salary after tax in 2019 when factoring in health insurance contributions pension contributions and other salary taxes in Malaysia. Malaysia Residents Income Tax Tables in 2019.

Business income B Form on or before 30 th June. Average Lending Rate Bank Negara Malaysia Schedule Section 140B. Personal income tax rates.

Dates section for further information.

Irs Audit Penalties And Consequences Polston Tax

Annual Business Tax Returns 2019 Treasurer Tax Collector

Indian Stock Market Tips Commodity Market Tips Equity Trading Tips Airtel Telenor Merger Gets Sebi Bse Nse Nod Stock Market Bharti Airtel Technology

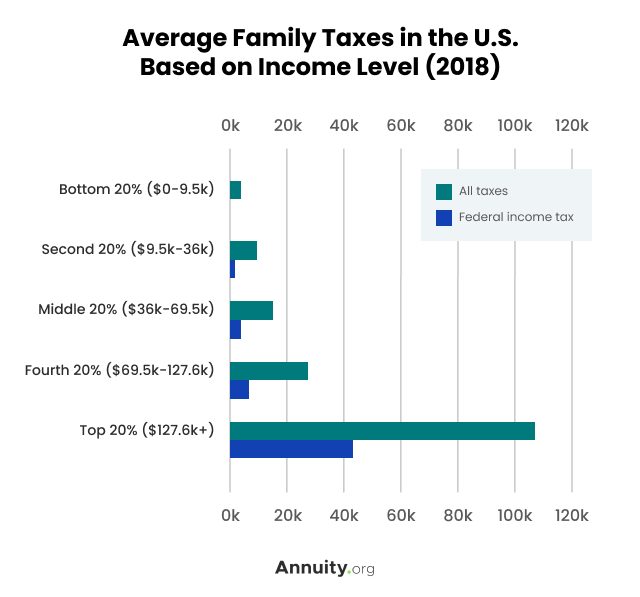

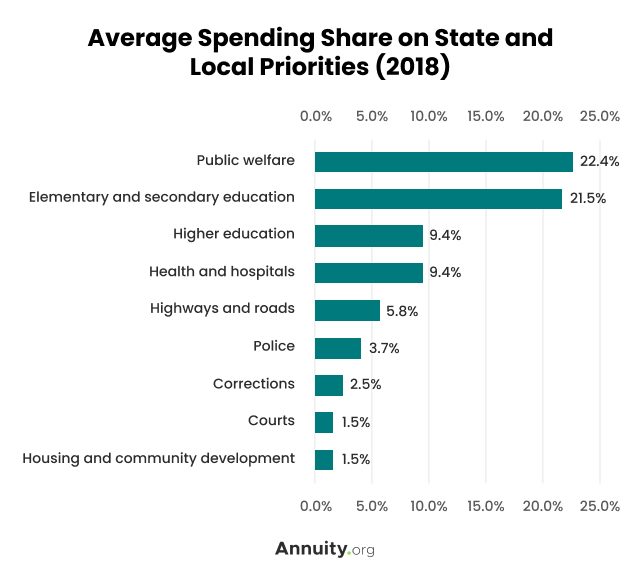

Tax Information What Are Taxes How Are They Used

Behind The French Menu Buying Cheese In France Bringing French Cheese Home And A Lexicon For Buying French Cheese French Cheese French Restaurant Menu Cheese

Tax Information What Are Taxes How Are They Used

Deadline For Submission Of Ad07 Case Response Questionnaire Ant Lawyers Industrial Trend Research Companies Marketing

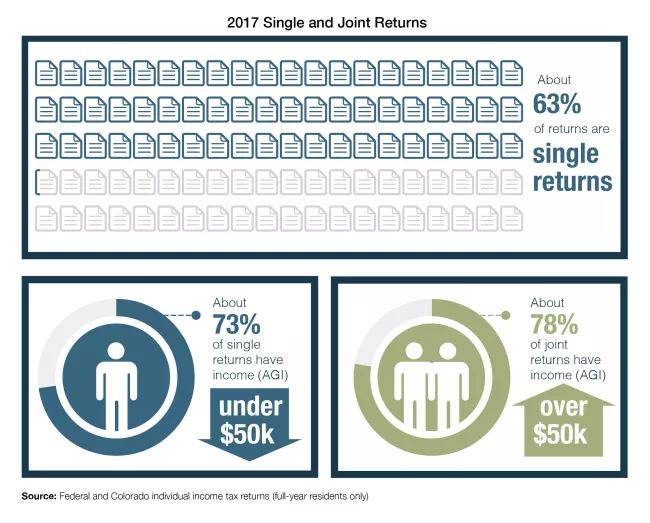

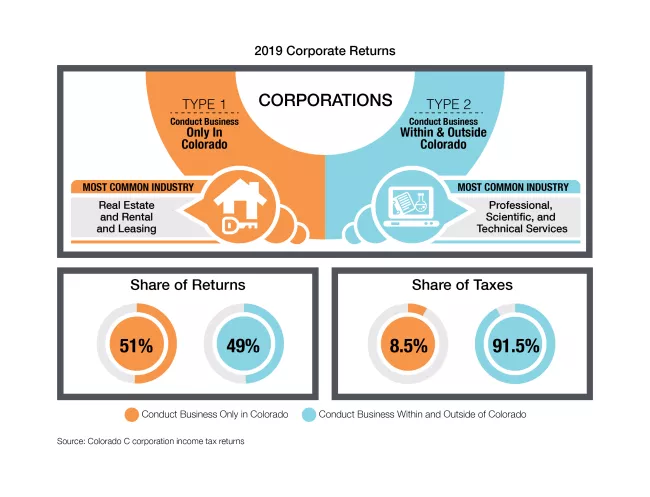

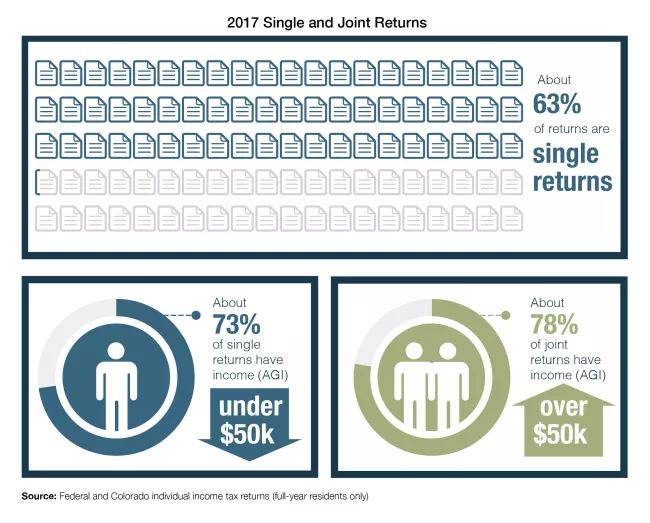

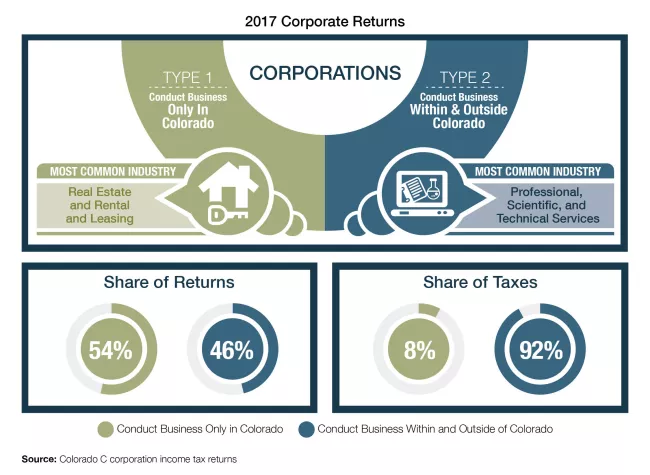

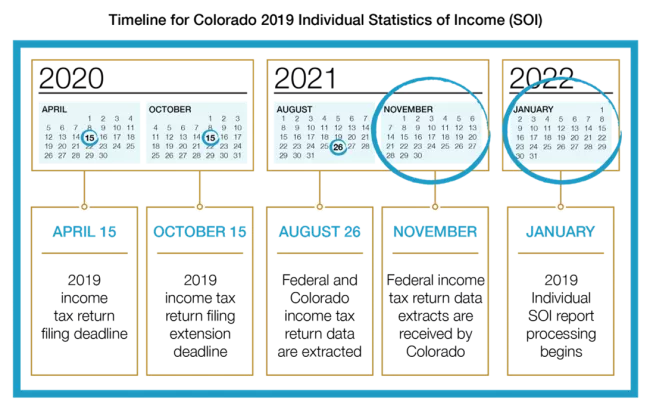

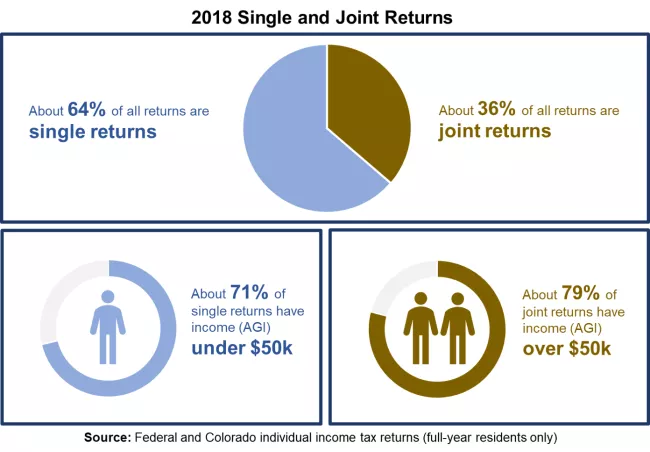

Statistics Of Income Reports Department Of Revenue

The Irs Is Behind In Processing Nearly 7 Million Tax Returns An Early Warning Sign The Agency Is Under Strain The Washington Post

Statistics Of Income Reports Department Of Revenue

The Irs Is Behind In Processing Nearly 7 Million Tax Returns An Early Warning Sign The Agency Is Under Strain The Washington Post

Statistics Of Income Reports Department Of Revenue

Taxes 2020 Everything You Need To Know About Filing This Year Cnn Business

12th Board Admit Card 2019 Hsc Intermediate Hall Ticket Medical Test Upsc Civil Services Civil Service Exam

Statistics Of Income Reports Department Of Revenue

Statistics Of Income Reports Department Of Revenue

Tax Information What Are Taxes How Are They Used

Income Tax City Of Gahanna Ohio